Public Buyers Bought More and Private Sellers Divested More Hotels Than on Average Before 2020

Originally posted by Jan Freitag, CoStar News

In 2023, some $23 billion of hotel assets changed hands, around half of the total transaction value of the prior year.

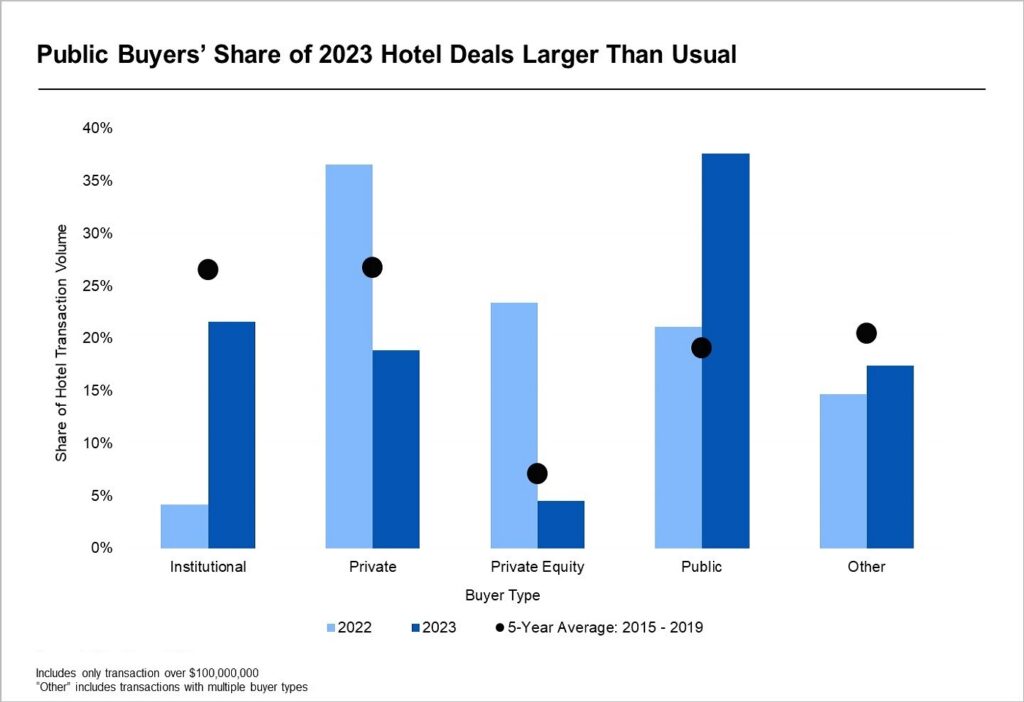

Of transactions over $100 million, a larger than usual share was bought by publicly traded companies. Last year just under 40% of all such transactions involved a buyer that was publicly listed, compared to 21% in 2022.

The 2022 results are similar to the pre-pandemic five-year average share of volume for publicly traded companies, which is around 19%. The 2023 results included the sale of the Bellagio Casino to Realty Income Corporation for just under $1 billion and Ryman Hospitality Properties’ purchase of the JW San Antonio resort.

In contrast, other types of buyers, such as institutional investors or private buyers, were less active compared to the pre-pandemic average. Back then, both types of buyers accounted for just over a quarter of hotel transaction volume each, but their shares dropped to around 20% last year. Three large purchases took place in New York City. The Park Lane Hotel sold for over $1 million per key to the Qatari Investment Authority, a portion of the Mandarin Oriental Hotel was sold to Reliance Industries for over $215 million, and the new Motto by Hilton was purchased by Magna Hospitality for $170 million.

The divergence in purchase share from the long-run trends is likely a function of the smaller sales volume.

Public companies bought over $4.6 billion in hotels in 2022 but only around $2.5 billion in 2023. This 55% drop is not as pronounced as the sharp deceleration in trading activity of other buyer types.

Private companies and private equity buyers dropped their purchase volume by almost 90% as higher interest rates and a continued divergence in bid-ask spread kept many participants on the sidelines.

Public companies, such as real estate investment trusts, on the other hand, may have seen an opportunity to bolster their portfolios with strategic buys they will likely hold for a long time.

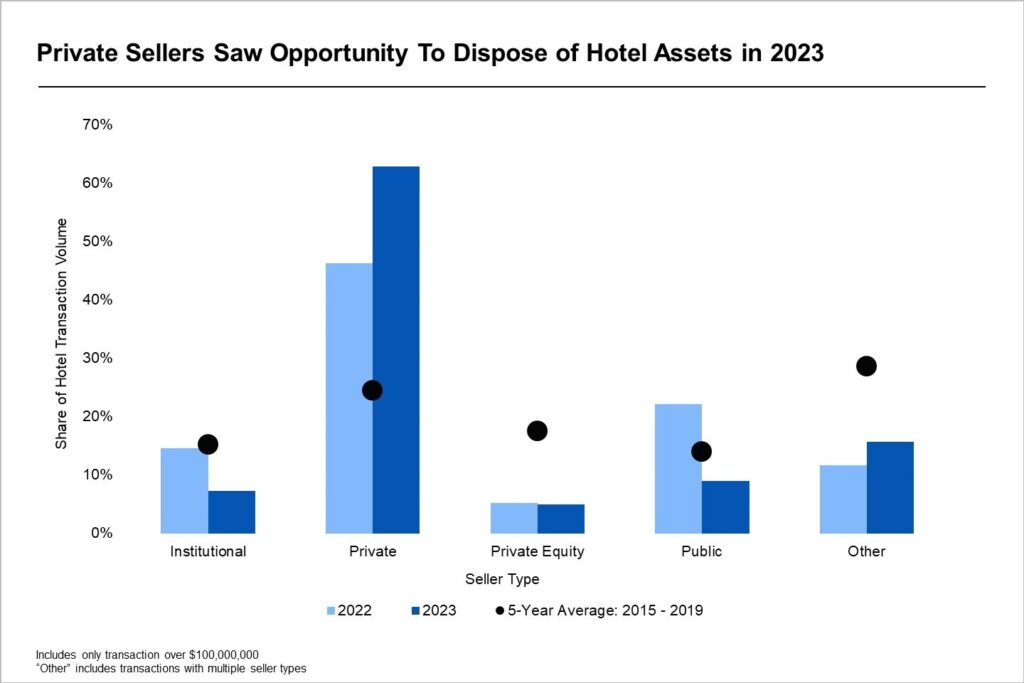

A disproportionate share of companies participating selling hotels in 2023 were private companies. Historically about a quarter of all hotel sales over $100 million have had a private seller, but that portion was just under 50% in 2022 and further increased to 65% in 2023.

All other buyer types had shares lower than the pre-pandemic average. For example, private equity companies, which used to account for one in every five dollars of sales, were involved in only 5% of overall hotel sales volume in both 2023 and 2022. Part of the reason for this drop was likely the lack of pricing transparency and the corresponding divergence in the “bid-ask” spread for hotel assets. In other words, the companies that did not have to sell did not.

Two private sellers that were involved in large dispositions last year were the non-listed Blackstone real estate income trust, B-REIT, with close to $2 billion in sales, and the MCSAM Group in New York City, selling three newly built Hilton properties on the same city block for just under $500 million.

For 2024, the expectation is that transaction volume will increase and the respective proportion of selling activity by buyer type should more closely resemble past years before 2020. The Fed has signaled that interest rates may have peaked, which could give buyers conviction to start underwriting hotel asset deals in earnest again. Also, loan maturities or brand-imposed property improvement plan expenses could force some owners to sell.