Nonresidential Lending Slows As About $885 Billion in Bank Loan Maturities Loom

Originally posted by Chad Littell, CoStar News

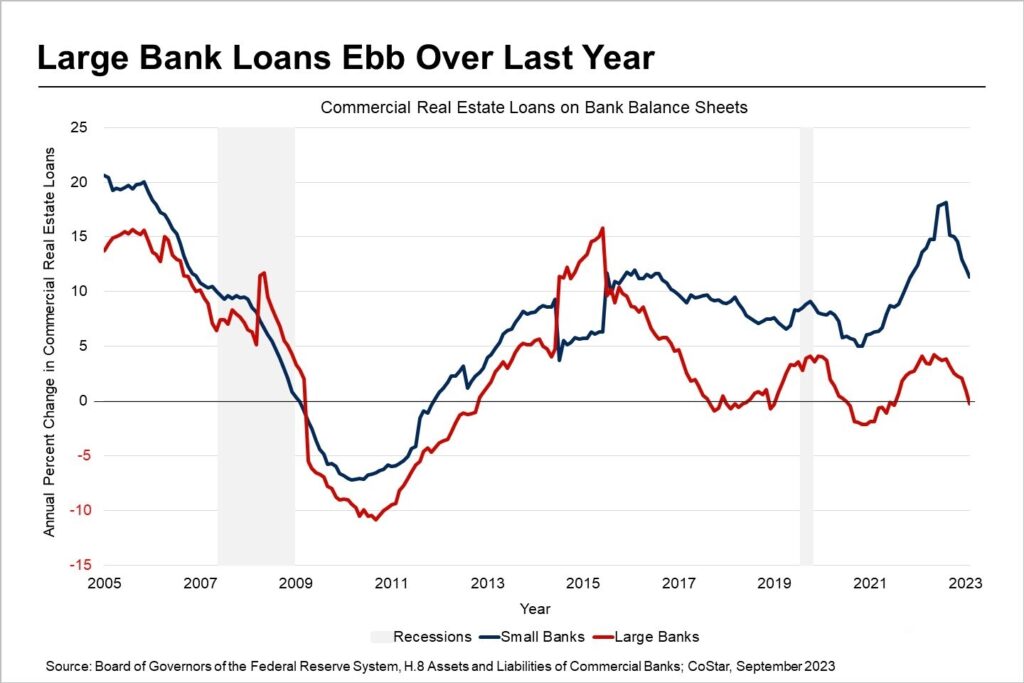

The top 25 banks by assets hold 31% of all commercial real estate loans on bank balance sheets. But in 2016, the growth of commercial real estate loans at large banks began to slow. The combination of increased banking regulations in the wake of the Great Recession, the expansion of non-bank lenders, and further competition from regional banks all led to more tepid loan growth among the top players.

A closer look at the divergence shows annual loan growth at regional and community banks averaged 9.7% over the past eight years, while large bank commercial real estate loan portfolios grew at one-quarter of that rate, increasing an average of just 2.6% since 2016.

Apart from recessionary periods, it’s rare to see bank balance sheets contract. It’s common to see loan growth slow as interest rates rise, but they rarely shrink.

According to the Federal Reserve, in August large domestic banks saw their aggregate loan balances tighten for the first time since January 2022, and their loan balances have declined further over the first two weeks of September. Commercial real estate loans at large banks fell 0.3% in the week ending Sept. 13, driven largely by nonresidential segments.

Loans at large banks secured by nonfarm, nonresidential properties comprise 60% of these loan books. Totaling $532 billion in August of 2022, loans to nonresidential properties sagged 3.8% in September 2023, while those secured by farmland dropped 9.1% over the same time. Loans for multifamily properties, however, continued to garner favor with large banks, where outstanding loans expanded by 3.9% in September compared to August 2022.

Despite the strong double-digit loan growth at the small bank level, the overall commercial real estate lending environment is becoming constricted. After reaching 18.2% annual loan growth in the first quarter of 2023, the pace of expansion decelerated rapidly among smaller lenders during the most recent six-month period.

Considering this slower lending trend, the next four years will face the challenge of having to contend with an estimated $1.9 trillion in commercial real estate loan maturities. Of this total, approximately 47%, or $885 billion, are on bank balance sheets, and close to 20% of these loans are tied to office properties. As this troubled property sector continues to make write-downs, small bank lenders may end up following the lead of the national lenders and using capital for purposes other than originating new loans at the same blistering pace as in 2022.

Should this backpedal scenario come to pass across all bank lenders, the risk of tighter credit conditions across all property types, not just for office properties, could weigh on transaction volumes and be a headwind for the future direction of property values.