Supply-Heavy Areas Report Weaker Rent Performances

Originally posted by Bill Kitchens, CoStar News

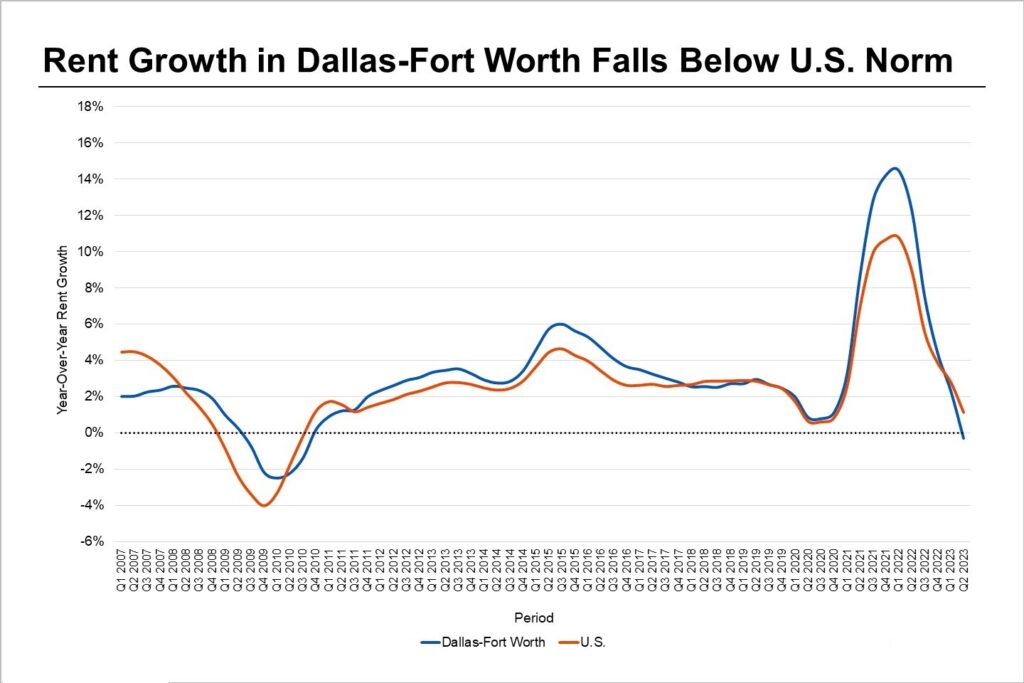

Annual rent growth in Dallas-Fort Worth trended negative in the second quarter for the first time since the third quarter of 2010. The market reported a -0.4% change in annual rent levels in the second quarter of 2023 as part of a broader theme of decelerating rent growth, coming off record-high rent increases in 2021.

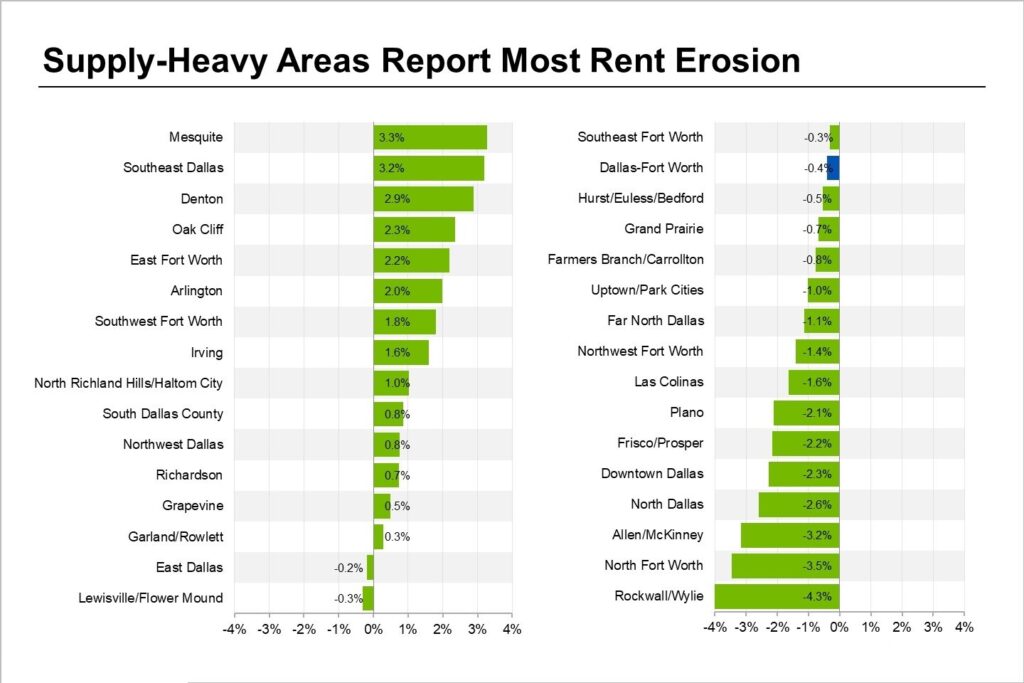

Apartment rents are cooling the fastest in pockets with heavy construction. Roughly half of regional renter hotspots report lower average rents, with the steepest declines in parts of Fort Worth and communities within Collin and Denton counties. Developers are pouncing on a continuous flow of new residents moving to northern counties, while Fort Worth led the country in new residents last year.

Reporting the sharpest decline in apartment rents, the Rockwall and Wylie area is down 4.3% over the past year and the area is facing a massive supply wave with 53% of its total inventory under construction. Market participants have reported rising concessions over recent months due to weaker demand in the past year, sacrificing rent growth to capture more new leases. Bucking the trend, Denton is reporting rent growth of 2.9% while weathering its largest apartment construction wave on record. Still, the future performance of Denton’s apartments remains under threat as new projects deliver.

Rent cuts have been deeper in the higher-end, four- and five-star-rated properties, where rents are down a collective 1.5% over the past year based on CoStar’s daily asking rent series. Virtually all recent deliveries identify as four-and-five-star properties. Meanwhile, the mid-tier, three-star-rated properties have proven more stable, with rent growth still trending positive at 1% over the past year. About 47% of multifamily properties in the Dallas-Ft. Worth region are identified as four- or five-star, while 53% are rated as three-star or lower.

A strong case can be made that apartment rent growth may recover faster here than in other Sun Belt markets. Renter demand is picking up through the first half of 2023, with net absorption, or the net change in units occupied and units vacated, reaching 5,345 units in the second quarter, within the range of pre-crisis norms. In addition, month-over-month rent performances show growth is stabilizing, and most rent declines appear to be in the rearview mirror.

With about 58,000 units under construction, the market ranks among the most active in the country. Even so, the supply picture is relatively more balanced than other Sun Belt markets, and the construction-heavy areas for new apartments coincide with where there is healthy population growth and in-migration to support demand.