High Nominal Rates Are Not the Problem, How Fast Rate Hikes Are Made Is What Surprises Market Participants

Originally posted by Chad Littell and Carl Gomez, CoStar News

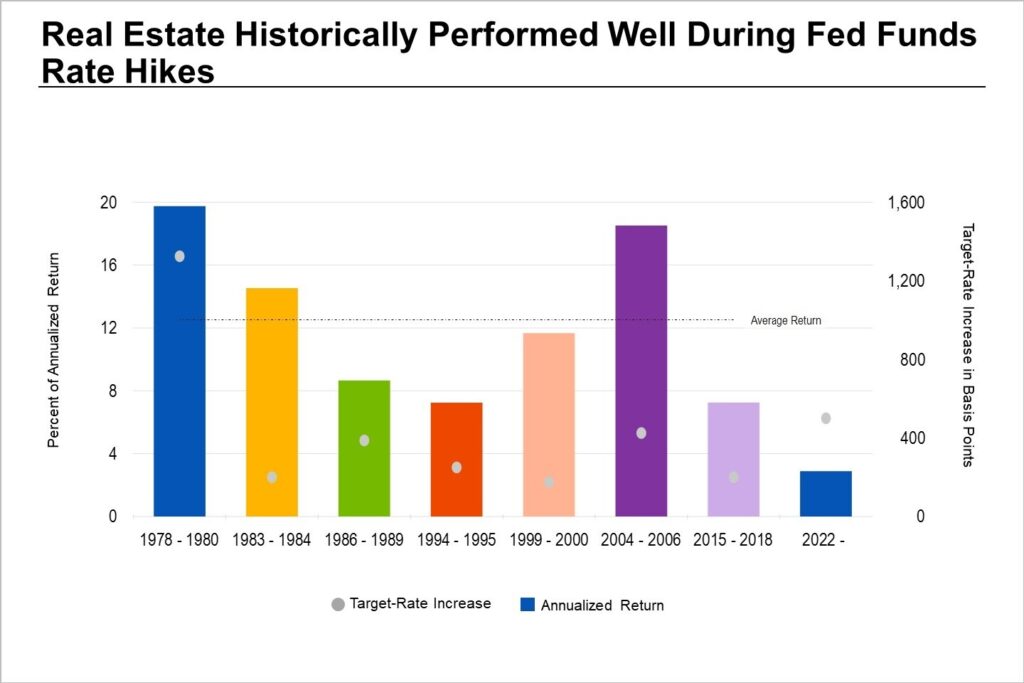

Investors have been concerned about how the Federal Reserve’s rate hikes affect commercial real estate values, and with good reason. Until recently, the market’s remedy was that if the Fed stopped hiking rates, asset values would return to the growth rates seen in 2021.

However, historical data reveals a more complex relationship between interest rates and investment returns. It isn’t the nominal levels of interest rates that matter to commercial real estate values. Instead, it’s the combination of the magnitude of interest rate hikes with the speed they are made are what have the most impact.

During periods of rising interest rates, the strong economic drivers that support real estate values tend to be on full display, which is why the Fed typically hikes rates during these times. As the economy heats up and businesses grow, they consume more commercial real estate, leading to higher rents and lower vacancy rates.

Counterintuitively, capitalization rates routinely compress in rising interest rate environments. The reason for this is that investors continue to bet on above-average rent growth and leasing performance to generate yields rather than prioritizing in-place cash flow. As the optimism of late economic cycles assumes that past experience will continue into the future, investors typically pay little attention to how quickly market dynamics can change.

With the Fed increasing its policy rate by 40% more in half the time compared to the average pace of rate increases made in the past seven cycles, the current hiking era stands out. Skyrocketing interest rates have weighed on economic growth as consumers are now incentivized to save rather than spend. At the same time, commercial real estate borrowers are forced to accept higher debt costs than they’ve seen in over a decade. Many will adjust, but a growing number will be unable to refinance or sell their way out of this dilemma.

In retrospect, a 5% federal funds rate should not have caused this much market uncertainty, considering that the long-term average rate since 1954 has been 4.6%. Looking back over the past economic cycle, years of zero-interest-rate policy encouraged investors to make what might be considered to be excessive risk-taking and over-investment in assets like commercial real estate.

The seeds of today’s anxiety were planted in 2012, when the Fed dropped its target rate to zero. After slowly bringing it higher, by 2019, the 2.5% hurdle proved too lofty a goal to reach heading into the headwinds of a slowing economy. As anticipated at the time, the Fed returned to its playbook of cutting rates to prop up asset prices at the first sign of volatility — a successful strategy in low-inflationary environments. This was well before any news of COVID-19 began to spread and financial turmoil sent rates back to the floor.

Along with economic growth, gradually hiking interest rates early is a strategy for the Fed to engineer soft landings. In the mid-1990s, the Fed’s quick response to budding economic growth and falling unemployment kept inflation and asset prices stable. Rates were preemptively raised — and held for more than six years — in a narrow band between 4.5% and 6.5%.

Despite these relatively high rates, there was no crisis. Thus, we might ask whether it is the nominal policy rate that affects commercial real estate returns or whether it is the pace of hikes that catches market participants by surprise. The current experience contrasted against the mid-1990s would suggest the latter.