Originally posted by Andy Peters, CoStar News

Wells Fargo, JPMorgan Chase, PNC Say High Vacancy Rates at Those Properties Could Spell Trouble

Wells Fargo, one of the largest U.S. commercial real estate lenders, set aside more money this year because of concerns some of those property loans could go bad. But the San Francisco-based bank and two other lenders are cautioning investors that the sky is not falling — at least not yet.

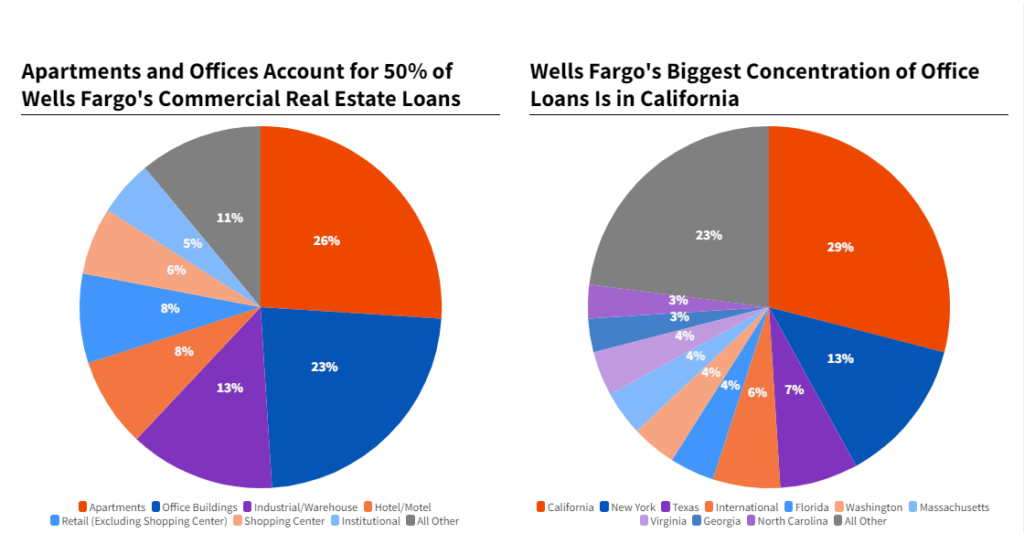

During the first quarter, Wells Fargo increased its loan-loss allowance by $643 million, an estimate of how much it won’t recover from bad loans. The bank singled out commercial real estate, and especially office loans, in putting the money aside, a move analysts say could become more common as the year goes on.

Executives at Wells Fargo, JPMorgan Chase and PNC Financial Services Group, which kicked off earnings report season for the banking industry Friday, said they are still making new loans on commercial properties. The recent failures of Silicon Valley Bank and Signature Bank may have rattled some investors, but banks say lending hasn’t come to a halt.

“I wouldn’t use the words credit crunch, if I were you,” said JPMorgan CEO Jamie Dimon in response to an analyst — who asked if there’s a credit crunch.

“Obviously, there’s going to be a little bit of tightening and most of that will be around certain real estate things,” Dimon said. “It’s not a credit crunch.”

Office Loans

However, with the threat of a recession still lurking, banks appear more focused than ever on commercial real estate loans, particularly on multitenant office buildings.

Office property borrowers should expect to get a call soon from banks, if they haven’t already, Stuart Plesser, senior director at S&P Global Ratings, told CoStar News. Loan officers want more clarity on what office owners plan to do about loans coming due soon.

“On loans coming due in the next year or two, it would be wise to have those discussions,” Plesser said.

Bankers have been focused on the financial condition of their office-based loan books for months. And regulators have warned banks since last summer to be on their toes, especially banks with the highest concentration of commercial real estate loans.

In coming weeks, some banks will probably ask borrowers to refinance outstanding loans, especially if the property’s value has declined in recent months, Plesser said. The additional equity that results will serve to protect banks if the loans go bad.

Limited Exposure

Wells Fargo, JPMorgan and PNC executives all stressed during Friday’s conference calls that exposure of those banks to risky office properties was limited

While Wells Fargo boosted its loan-loss allowance, Mike Santomassimo, the bank’s chief financial officer, said during the call that was a defensive move in the event the office market worsens.

“This will likely play out over an extended period of time,” Santomassimo said. “We’re not seeing a lot of near-term stress.”

Commercial real estate is a small part of JPMorgan Chase’s overall banking business and its portfolio includes few distressed properties, according to Jeremy Barnum, JPMorgan’s chief financial officer.

“Let me remind you that our office sector exposure is less than 10% of our portfolio and is focused in the urban dense markets,” Barnum said.

The office market represents only 2.7% of PNC’s total $36 billion commercial real estate loan book, said Robert Reilly, PNC’s chief financial officer. About 0.2% of those loans are delinquent, he said.

Multitenant office buildings are the area of concern for PNC and the buildings attached to loans in its portfolio are about 70% occupied, Reilly said.

“That’s where we see increasing stress and a rising level” of assets being transferred to delinquency, Reilly said.

But, banks’ portfolios of commercial real estate loans have continued to grow. At Wells Fargo, commercial real estate loans rose 3.1% to $154.7 billion in the first quarter compared to the same time a year earlier. PNC’s commercial property loans increased 5.3% to $35.9 billion.

JPMorgan does not break out figures for commercial real estate lending in quarterly earnings reports. It will file those numbers later this month with federal regulators.

Other Lenders

If borrowers aren’t willing to fork over more equity, they could search for a nonbank lender that’s willing to take on more risk and refinance their loan. But even nonbank lenders are being more cautious these days, Brendan Browne, senior director at S&P Global Ratings, told CoStar News.

“Nonbank lenders may be less willing to make that type of loan today than they were a year ago,” Browne said.

Browne said he expects to see more office owners let properties go into foreclosure this year, rather than wager more of their own equity to refinance a loan.

The Century Plaza mixed-use development in Los Angeles was sold in a foreclosure auction in early April to two British billionaire brothers. Columbia Property Trust in February defaulted on a $1.72 billion loan backed by seven office towers in a step toward a potential foreclosure.

Two regional banks — M&T Bank in Buffalo, New York, and Pinnacle Financial in Nashville, Tennessee — report first-quarter earnings on Monday. About two dozen other banks will issue earnings reports later in the week, including Bank of America and Goldman Sachs.