Originally posted by Bill Kitchens, CoStar News

Healthy Demand, Limited Supply Drives Competition for Space

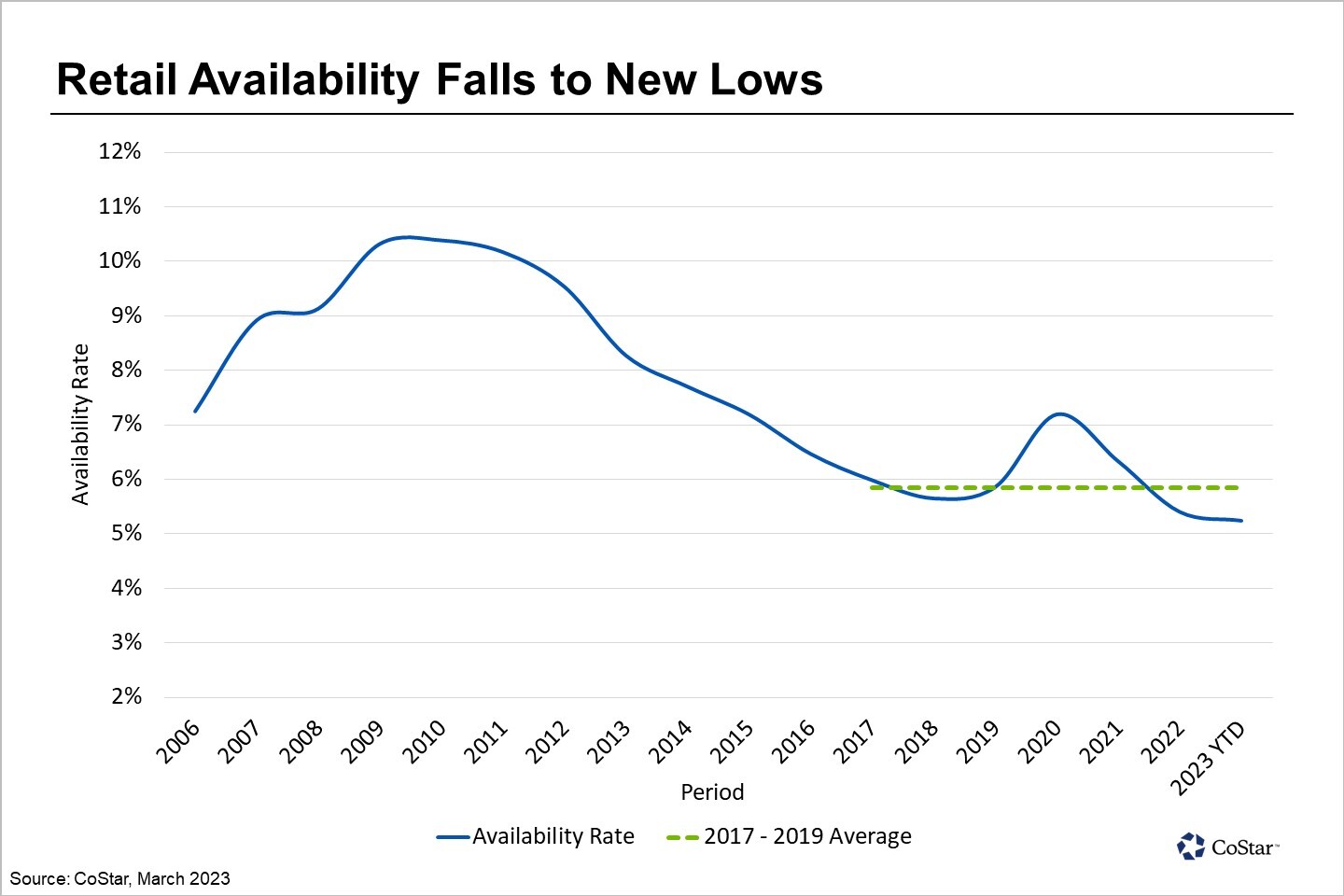

Thanks to consistent, resurgent demand for retail space over the past two years, the availability of retail space in the Dallas-Fort Worth region has compressed. The availability rate, or the share of space marketed and available to tenants, has fallen to 5.2%, a new low for the market. That rate is below the average reported from 2017 to 2019 of 5.8%.

The market is reporting 24 million square feet of available space, the lowest level since mid-2018. Areas with the lowest availability rates vary in terms of geography and quality. Properties rated as three-star and below carry an availability rate of 6%, while four-and-five star properties register 3.7% availability.

The lowest availability rates are found in affluent urban and suburban neighborhoods. Areas that are relatively supply constrained also report tighter availability rates. These include sections in east and north Dallas and within the city’s Uptown district.

Meanwhile, the highest availabilities are found in areas with fewer retail destinations along with aging retail inventory. For example, some northern suburban areas like sections of Carrollton, Plano and to the east, Mesquite, have a relatively higher availability rate.

Dallas-Fort Worth’s retail market is tightening with steady demand eclipsing supply coming to market. From 2021 through the first quarter of 2023, the market has absorbed 10.7 million square feet, while 4.3 million square feet have delivered. Continuous demand is creating greater competition among would-be tenants seeking well-located space. Market leaders from brokerage firms cite continued interest from retailers seeking to enter or expand their presence in Dallas-Fort Worth. They indicate this dynamic is likely to continue unless construction picks up, an unlikely prospect.

The supply side remains tempered in terms of construction, demolitions and the amount of space tenants are putting back on the market. The market is reporting 4.2 million square feet underway, roughly half of the 8 million square feet in 2016 when construction peaked during the last expansion. Developers continue to face difficulty sourcing materials and rising interest rates are pushing the cost of construction financing higher.

Meanwhile, rising demolitions are also removing space as part of the market’s inventory. The market has seen 2.5 million square feet demolished driven by several mall renovation projects, including Collin Creek Mall in Plano. The 1.2 million-square-foot shopping center was demolished in 2021 and the site is now being redeveloped into a $1 billion mixed-use campus by Centurion American of Farmers Branch, a Dallas suburb. Fewer tenants are giving back space from the store closures from 2020. The market saw tenants JCPenney and Pier One Imports vacant large spaces from the latest downturn. Most of that space has been taken and store openings outpace store closures.